Middle East and Africa International Banking Convention 2016

The Asian Banker gathered the Middle East and Africa’s key decision makers for a dialogue on “Retail Banking Facing a Fintech Uprising” at the Middle East and Africa International Banking Convention 2016.

Our keynote speakers included:

- Tayfun Küçük, chief technology officer, OdeaBank, Turkey

- Gray Stern, chief commercial officer and co-founder, Landbay, UK

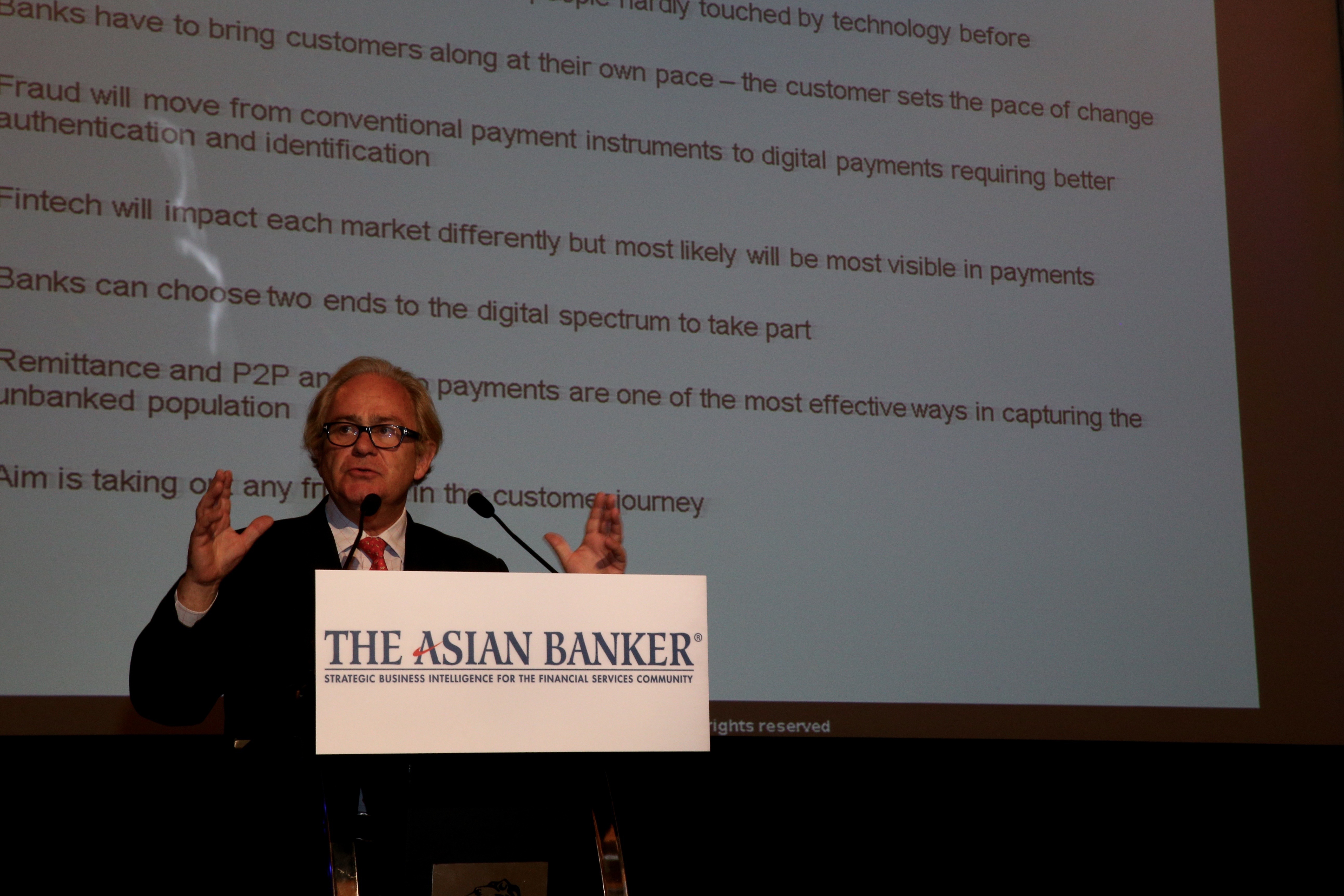

Summarising our discussion:

- Mobile takes banking and computing to people hardly touched by technology before

- Banks have to bring customers along at their own pace – customers set the pace of change

- Fraud will move from conventional payment instruments to digital payments requiring better authentication and identification

- Fintech will impact each market differently but most likely will be most visible in payments

- Banks can choose two ends to the digital spectrum to take part

- Remittance and P2P macro payments are some of the most effective ways in capturing the unbanked population

Held at The Ritz Carlton, Dubai International Financial Centre, Dubai, United Arab Emirates on the 20th of April 2016.

These photos are also available in our Facebook album for our attendees to tag and share with their network.

Event Album

Live Tweets: #MEAIBC16

#Research: #MEA retail #banking focused on cust relationship. https://t.co/gbuXwvYHfv Will be discussed at #MEAIBC16 pic.twitter.com/wocYQITr2f

— The Asian Banker (@TheAsianBanker) April 1, 2016

2 hrs to go & the '#MiddleEast & #Africa Int'l #Banking Convention in #Dubai begins! Watch this space for #live updates! #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

#RetailBanking is Facing a #Fintech Uprising | Look out for @GrayStern at #MEAIBC16 in Dubai today @TheAsianBanker

— LANDBAY (@LandbayUK) April 20, 2016

Interview w/ @GrayStern, co-founder & CCO @LandbayUK & #keynote speaker at #MEAIBC16 by our chairman @EmmanuelDaniel pic.twitter.com/DWhFvAkfNl

— The Asian Banker (@TheAsianBanker) April 20, 2016

#MEAIBC16 has started w 1 of our #keynote speakers @tayfunkucuk CTO of @odeabank on his bank's #mobile #banking exp. pic.twitter.com/MmIkv2ztbG

— The Asian Banker (@TheAsianBanker) April 20, 2016

"@amazondash, @Macys , & #Apple are leading #omnichannel. Why not the #financial services industry?" – @TayfunKucuk, @odeabank CTO #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"@odeabank's #mobile #banking is unified across all platforms. A trxn can start on 1 channel & finish on another." – @TayfunKucuk #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"Customers care abt seamless service, not applications in core #banking." – Faisal Hamed Al Wahaibi, chief retail ofcr @BankDhofar #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

At the "Retail #Banking Facing a #Fintech Uprising" #dialogue, discussing how reach the unbanked & more. #MEAIBC16 pic.twitter.com/bQn4eZgxnT

— The Asian Banker (@TheAsianBanker) April 20, 2016

"#Unbanked vs #mobile penetrative: banks need to take risks & cater to #millennials to expand." Faisal Al Wahaibi, @BankDhofar #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"People still like to visit physical (bank) branches." – Tanvir Shah of ADIB (@ADIBTweets). #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"The branch isn't dead yet. It is a point of generation for most customers." @EmmanuelDaniel, chairman @TheAsianBanker #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"#Fintechs w relatively low resources compete w retail businesses that have massive resources." – @GrayStern co-founder @LandbayUK #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"You have built trust & longterm relationships w customers," says @GrayStern, on why banks shouldn't be fearful of #fintechs. #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"#Tech is not a challenge but something pursued to improve #customer experience." – Akif Shiekh, AGM retail #banking, @AlRajhiBank #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"#Partnership is key as we don't have the skill set of #fintechs but we do have a #customer base." – @stewart_lockie, @Abk_kuwait #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"Picking the right thing for the right people is helping to maintain cost." – @stewart_lockie, GM retail #banking @Abk_kuwait #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"Battling customer demands is manageable but becomes a challenge when coupled w regulatory reqs." @stewart_lockie @Abk_kuwait #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

Discussing abt reshaping the #digital ecosystems of banks & competing w #fintechs. #MEAIBC16 pic.twitter.com/SjxTihbMrP

— The Asian Banker (@TheAsianBanker) April 20, 2016

"We must have both #innovation lab & accelerators." – Sanjay Malhotra, chief consumer #banking, #Dubai Islamic Bank (@DIBtoday) #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"We're investing in STP for credit #underwriting process & moving towards streamlining ops." Sudhir Sagar, Comm'l Intl Bank #Egypt #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"Even with the operation cost of #remittances going up, fees are not escalating." – Osama Al Rahman, chairman, #FERGUAE. #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

"Banks must partner w #mobile operators but only for support on trxn side." – Japhet Justine @NMBTanzania. #MEAIBC16 pic.twitter.com/vnJ0HKNuGc

— The Asian Banker (@TheAsianBanker) April 20, 2016

"#KYC photo verif. integrated w core #banking & all done w #fintech. Building an ecosystem is key." – Japhet Justine @NMBTanzania #MEAIBC16

— The Asian Banker (@TheAsianBanker) April 20, 2016

#Teaser: @BConversation w/ Chairman Osama Al Rahman of #ForeignExchange & #Remittance Group #UAE. #MEAIBC16 pic.twitter.com/IqlYNTc9vu

— The Asian Banker (@TheAsianBanker) April 20, 2016

The #MEAIBC16 is followed by a recognition dinner. We'll announce the awardees in our Facebook album, so follow #MEAIBC16 for updates!

— The Asian Banker (@TheAsianBanker) April 20, 2016

No comments yet... Be the first to leave a reply!