Financial Crime 360 Conference 2015

The Financial Crime 360 Conference: “Understanding the many faces of financial crime in the Asia Pacific region” brought together regulators, law enforcement officials and compliance practitioners from MNCs, SMEs as well as financial institutions to exchange best practises, technology trends and the latest criminal modus operandi experienced in the financial services industry.

Held on 24th November 2015 at The South Beach, Singapore.

Key Speakers:

- Jimmy Gurule, Former Under Secretary, Dept. of the Treasury, USA

- Mohd Zabri Adil B. Talib, Head of Digital Forensics, Cyber Security, Malaysia

- Dante Fuentes, President, Association of Bank Compliance Officers, Philippines

- David E. Vignola, Head, Compliance, Private Banking & Wealth Management,

Standard Chartered Singapore - Joe Chan, Head Intelligence, Financial Crime and Security Services, DBS Singapore

- Alan Seow, Cyber Security Head, Ministry of Communications & Information, Singapore

Held on November 24, 2015 at The South Beach, Singapore.

These photos may be tagged and shared via our Facebook album.

Event Album

Video Clips

Live tweets #FC360

#FC360 Banks implement what's minimally reqd of them in terms of compliance standards- Prof Jimmy Gurule, Notre Dame pic.twitter.com/VqtKE1Hv0o

— The Asian Banker (@TheAsianBanker) November 24, 2015

#FC360 In the #Philippines the most serious economic crime is graft and #corruption– Dante Fuentes pic.twitter.com/eRCwlRa1dg

— The Asian Banker (@TheAsianBanker) November 24, 2015

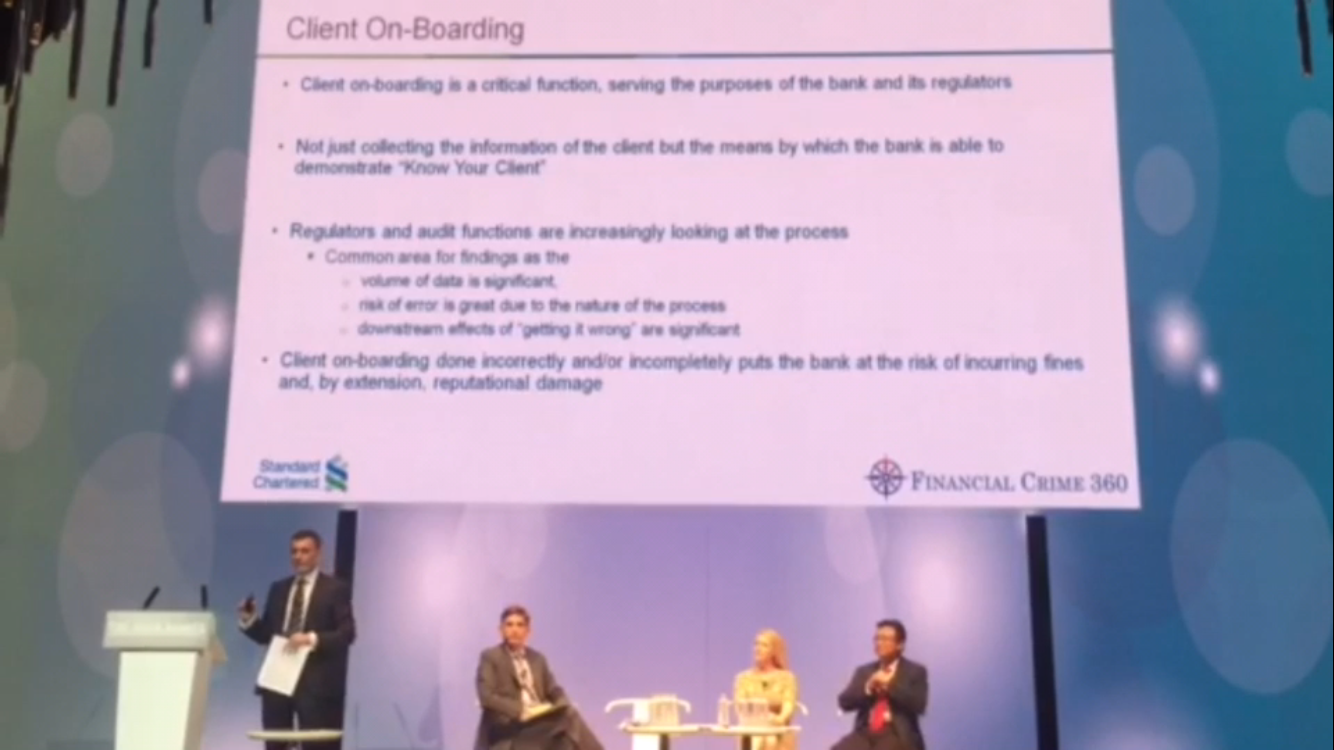

David Vignola, @StanChart head of compliance, private #banking & wealth mgmt on client onboarding & KYC. #FC360 pic.twitter.com/ATaUyjiLON

— The Asian Banker (@TheAsianBanker) November 24, 2015

Oonagh McKinley-Hutchinson on tackling #AML challenges w/ proper CDD & #KYC procedures. #FC360 pic.twitter.com/MhZj9GzNkq

— The Asian Banker (@TheAsianBanker) November 24, 2015

"Speed of trxn will be a problem for banks as it will get harder for banks to monitor & detect." David Vignola, @StanChart #FC360 #dialogue

— The Asian Banker (@TheAsianBanker) November 24, 2015

"When the big people get in trouble the little people get ethics training." #FC360 pic.twitter.com/pPQldG20GZ

— Mobasher Zein Kazmi (@MobasherZein) November 24, 2015

"Snr mgmt must know that proper record-keeping & logging are key to protect the business when transgressions occur." – Dante Fuentes, #FC360

— The Asian Banker (@TheAsianBanker) November 24, 2015

"Mitigating business risk requires having evidence readiness of suspicious transactions." – Mohd Zabri Adil Talib of @cybersecuritymy #FC360

— The Asian Banker (@TheAsianBanker) November 24, 2015

.@EricPesik of @Seagate #Singapore on building a sustainable & ethical corporate culture. #FC360 pic.twitter.com/G8fjfdTRxj

— The Asian Banker (@TheAsianBanker) November 24, 2015

#KYC must be continuous, spontaneous & ongoing for the business to operate w the right information at the right time. – Vignola #FC360

— The Asian Banker (@TheAsianBanker) November 24, 2015

"Quality of the #KYC process depends on the quality of info collected & the ability to corroborate that data." – Joe Chan, @dbsbank #FC360

— The Asian Banker (@TheAsianBanker) November 24, 2015

No comments yet... Be the first to leave a reply!